On May 14th-15th, the final of the China National College Students Competition on Energy Economics (CNCEE) sponsored by the Chinese Society of Optimization, Overall Planning and Economical Mathematics was held in Zhengzhou University. A team of graduate students from the Department of Earth System Science, Tsinghua University consisting of Li Haoran, a doctor of Class 2018, Weng Yuwei and Qian Yukun, doctoral candidates of Class 2017, and Xu Kaizhi, a doctoral candidate of Class 2018, won the First Prize and the Best Research Report Award.

Photo: Certificates of Award

Based on the current overall trading situation of the national carbon market, the team conducted a survey, finding that the current trading activity of the market was low, which was not only related to the operating mechanism of the carbon market, but also affected by the overall oversupply of power generation enterprises and the reluctance of emission control enterprises to sell. To address this problem, the team members collected the actual operation data of coal-fired power units with a capacity of more than 600 million kilowatts in 2020, investigated and calculated the emission quotas and emissions of coal-fired power enterprises. Their findings were as follows: In terms of the total quota, the average surplus of the total quota of coal-fired power units with a capacity of 300,000 kilowatts or more was about 9%, and the total surplus was about 352 million tons. Under the current accounting standards, the surplus free quota, carried forward and retained, has become an important hidden asset of thermal power enterprises, with a value as high as RMB 17.6 billion yuan (carbon price at RMB 50 yuan/ton). Meanwhile, the team found that, based on the current quota setting scheme, the carbon emission quota of large coal-fired units under actual working conditions will decrease with the increase of the heating proportion of the units. In terms of energy consumption, this does not promote power generation enterprises to improve energy efficiency through cogeneration, thus inhibiting the motivation of large coal-fired power units to carry out retrofit for heat delivery.

This research has provided not only important evidence for understanding the potential impact of carbon trading on power generation enterprises,but also reference for improving and optimizing the setting and allocation scheme of carbon emission quotas in the future. Meanwhile, the report has also proposed some suggestions, such as the need to constantly improve the relevant laws and regulations of carbon emission trading, enhance the policy certainty of market mechanism development, introduce more market players in a timely manner, and bring into play the role of carbon emission rights in market regulation and price discovery in the carbon market more effectively and clearly.

Wang Chan, a double-employed professor at the School of Environment and the Department of Earth System Science, Tsinghua University, is the faculty advisor of the team. The research work is funded by Southern Energy Watch journal and Duke University in Kunshan.

The China National College Students Competition on Energy Economics, aiming to promote the cross-integration of energy economy and related disciplines, encourages college students to provide solutions and policy suggestions for energy and environmental problems through practice and research. This competition saw the participation of more than 5,000 teams from all over the country, and a total of 2,543 valid works including research papers, research reports and other categories entered the jury evaluation stage.

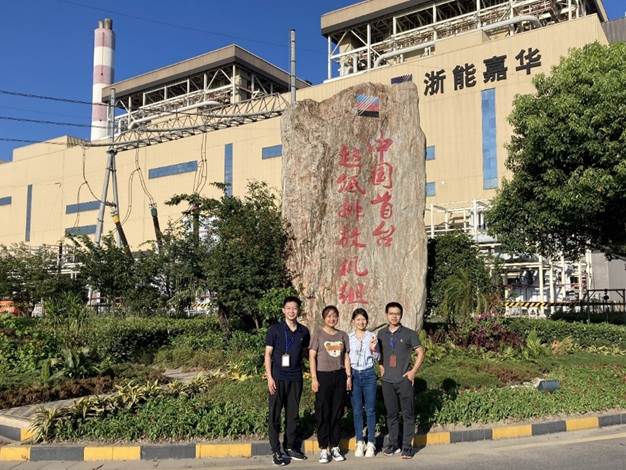

Photo: The team investigated Zhejiang Energy Jiaxing Power Plant, which participated in the first day trading of the national carbon market.

Relevant information:

[1] Li Haoran, Weng Yuwei, Xu Yunzhi, and Qian Yukun. Opportunities and challenges of electric power enterprises in the construction of national carbon market [J], Southern Energy Watch, 2022(2):84-103

[2] Li Haoran, What is the value of carbon quota assets held by power generation enterprises? [OL], Green Finance Forum of 60 (GF60), https://mp.weixin.qq.com/s/8EGlvPdIaK1iEt9UJ89Zzg

Contributed by Xu Yunzhi, Li Haoran, Weng Yuwei and Qian Yukun